So you’re eyeing the agricultural scene in Kenya and wondering how to get your hands on that sweet funding to turn your farm dreams into reality? You’re not alone. Kenya’s agricultural sector is buzzing with opportunities, but let’s be real—getting the cash to fuel your agribusiness ambitions can feel like trying to grow crops without rain.

Here’s the good news: there’s more money flowing into Kenyan agribusiness than ever before. From government-backed initiatives to international partnerships, the funding landscape is fertile ground for young entrepreneurs ready to dig in.

The Current State of Agribusiness Funding in Kenya

Kenya’s financial market stands out in East Africa, offering everything from traditional banking to mobile money solutions. But here’s the twist—despite all this financial muscle, agriculture still gets the short end of the stick when it comes to lending patterns.

Why? Most financial providers aren’t exactly rushing to back agricultural ventures. Even though small and medium agricultural enterprises provide about 80% of the food Kenyans eat, most operate off the books and remain vulnerable to market shocks and climate curveballs.

Recent years haven’t been kind to Kenyan farmers either. From unpredictable weather to floods, pest invasions, and COVID-19 disruptions, the sector has taken hit after hit—highlighting why dedicated financial support is critical now more than ever.

The silver lining? Digital innovation is revolutionizing how financial services reach farmers. New tech-driven products are emerging that actually make sense for agriculture’s unique rhythm:

- Weather station and satellite-based insurance

- Area-yield indices insurance

- Livestock and crop insurance options

These aren’t just fancy tech terms—they’re practical solutions designed to make financial services work for you, not against you.

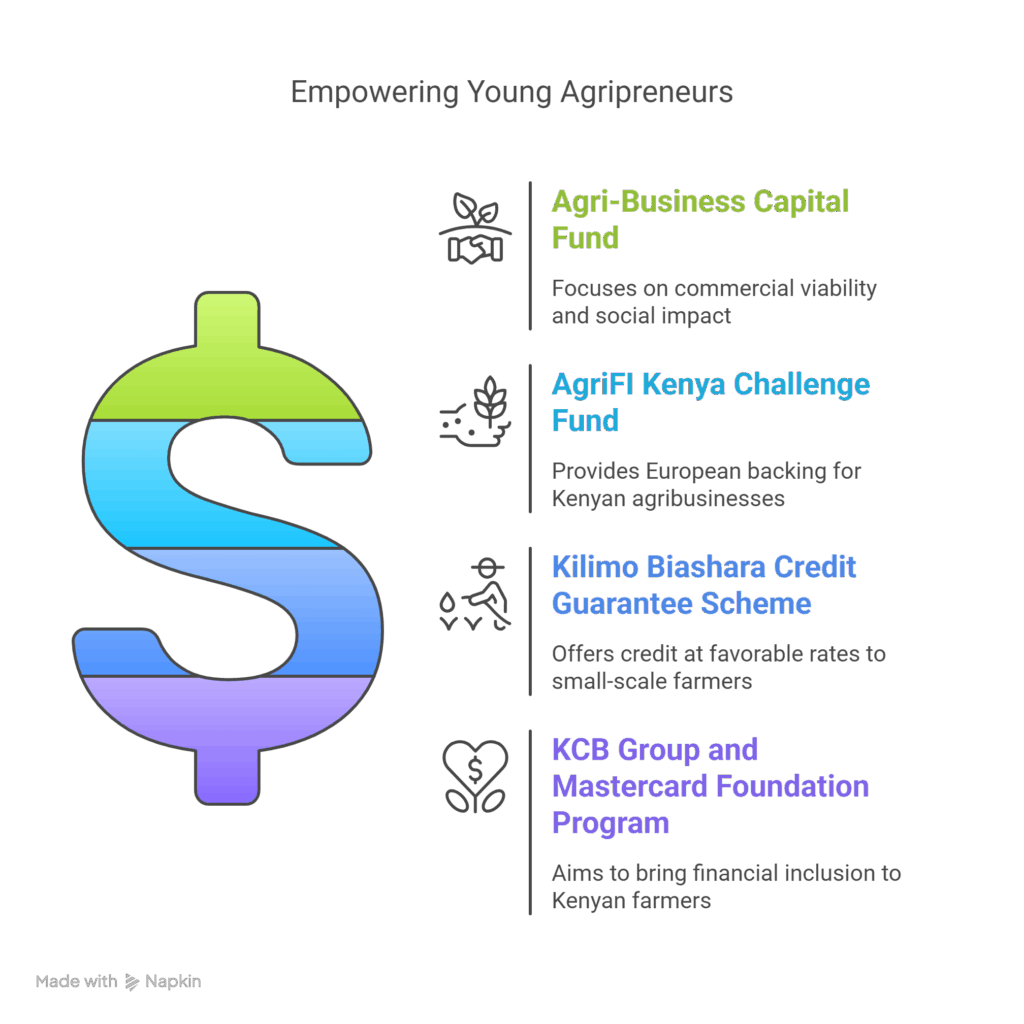

Major Funding Programs Every Young Agripreneur Should Know

Agri-Business Capital Fund (ABC Fund)

If you’re looking for serious backing for your agricultural venture, the ABC Fund should be on your radar. This isn’t just another funding program—it’s specifically designed for rural SMEs, farmers’ organizations, and agri-entrepreneurs like you.

What makes the ABC Fund stand out is its focus on commercial viability with a social impact angle. They’re looking for ventures that can create jobs, especially for youth and women, while improving rural livelihoods. The fund provides both loans and equity investments, giving you flexibility based on your business needs.

AgriFI Kenya Challenge Fund

Ready for some European backing? The AgriFI Kenya Challenge Fund is a multi-year project backed by the European Union and Slovak Aid that’s pumped over €18 million into Kenya’s small and medium-sized agribusiness sector.

The numbers speak for themselves:

- 192,000 farmers reached in six years

- 30 Kenyan producers, processors, and service businesses funded

- Thousands of new jobs created

- New markets opened for farm families

What’s particularly cool about AgriFI is its focus on businesses in underserved areas with limited job opportunities. They’ve backed companies across diverse agricultural subsectors—from fisheries and fruits to nuts, vegetable oils, and coffee.

When it comes to the money, individual financial support ranges from €200,000 to €750,000, covering up to 50% of total project costs. That means you’ll need to match the other half, but getting half your project funded is nothing to sneeze at. More details about the financial support are available on the AgriFI Challenge Fund website.

Kilimo Biashara Credit Guarantee Scheme

Let’s talk about a partnership that’s changing the game for small-scale farmers. The Kilimo Biashara Loan Scheme Initiative brings together the Alliance for a Green Revolution in Africa (AGRA), Equity Bank, and the Kenyan government to provide credit at interest rates that won’t break your bank.

Here’s the breakdown:

- Equity Bank committed to dish out USD 25 million to smallholders and agribusinesses

- AGRA set up a USD 2.5 million “cash guarantee fund” to buffer the bank’s risk

- Two types of loans available: farmer input credit and small business loans

- Smallholder farmers get loans at 10% interest (instead of the usual 18%+)

- Agribusinesses access credit at 15%

This scheme solves one of the biggest headaches for young agripreneurs—collateral. With little or no collateral, you can still access funding thanks to the guarantee that covers part of the risk.

KCB Group and Mastercard Foundation Agricultural Finance Program

Talk about going big—KCB Group and the Mastercard Foundation recently announced a USD 30 million agricultural finance program aimed at bringing financial inclusion to two million Kenyan farmers.

KCB Group has put up USD 15 million (Ksh 1.5 billion) and plans to inject an additional USD 200 million (Ksh 20 billion) in credit. If you’re a young agripreneur looking to scale, this massive initiative should definitely be on your funding radar.

Success Stories to Inspire Your Agribusiness Journey

Farmworks: The Tech-Powered Agri Success

In August 2023, Kenyan agtech startup Farmworks secured USD 4 million in pre-Series A funding. Founded in 2018, this innovative company uses data analytics, AI, and IoT sensors to give farmers insights into crop management, weather forecasting, and pest control.

Their user-friendly mobile app provides personalized recommendations and timely information on crop care, disease prevention, and optimal harvesting—proving that investors are ready to back tech-driven agricultural solutions in Kenya.

Self Help Africa’s Impact through AgriFI

Self Help Africa’s implementation of the AgriFI Challenge Fund has reached almost 200,000 small-scale farmers, generating vital household income across Kenya. The impact stories are as diverse as Kenya’s agricultural landscape:

- A company providing mobile veterinary services to remote communities with semi-nomadic herders

- A business purchasing and processing gum Arabic harvested by nomadic tribespeople from acacia trees in Kenya’s far north

These examples show that funding isn’t just flowing to conventional farming—it’s reaching innovative business models that solve unique challenges in the sector.

Types of Funding You Can Actually Access

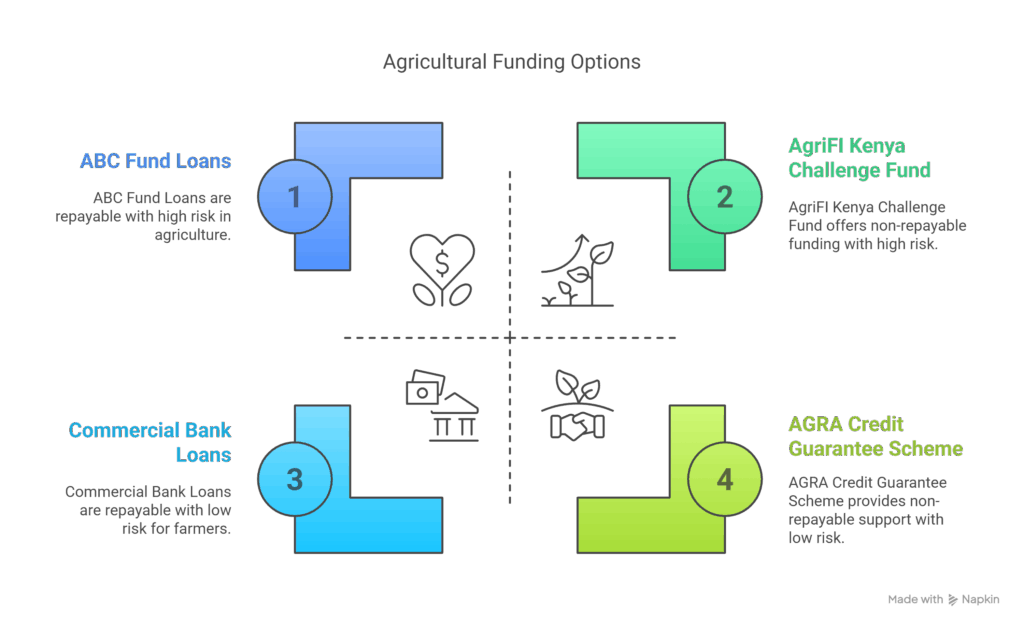

Loans and Equity Investments

If you’re looking for traditional financing with an agricultural twist, several options exist:

- The ABC Fund offers loans and equity investments tailored specifically for agricultural enterprises

- Commercial banks like Equity Bank have loan products designed for farmers and agribusinesses, often with preferential interest rates through special programs like Kilimo Biashara

The key difference from regular commercial loans? These are designed with the agricultural business cycle in mind, recognizing that your cash flow might not look like other businesses.

Grants and Challenge Funds

Not all funding needs to be paid back. Grant funding through initiatives like the AgriFI Kenya Challenge Fund provides partial funding for eligible projects—typically covering up to 50% of the total project value.

The catch? You’ll need to secure matching funds for the remainder. But getting half your project funded through grants is a significant boost that can make other investors more likely to back you too.

Credit Guarantee Schemes

These clever financial instruments help reduce the risk for banks lending to agricultural businesses. Programs like the one established by AGRA for Kilimo Biashara cover a percentage of potential losses, making banks more willing to take a chance on young agripreneurs without extensive collateral or credit history.

Challenges You’ll Face (And How to Overcome Them)

Let’s keep it real—accessing agricultural funding in Kenya isn’t a walk in the park. Most agricultural MSMEs operate informally, which limits access to formal financial services. Add to that the sector’s vulnerability to climate shocks and market disruptions, and you can see why financial institutions get nervous about agricultural lending.

But here’s how you can flip the script:

- Formalize your business – Get your registration, licenses, and bookkeeping in order

- Build a digital footprint – Use mobile banking and digital payment services to create a financial track record

- Explore risk mitigation tools – Look into agricultural insurance products that can protect your business

- Start small and build credibility – Successfully managing smaller loans builds trust for larger funding

Digital Innovation: Your Secret Weapon

The digitalization of financial services is creating opportunities you couldn’t imagine just a few years ago. Mobile-based financial services have already transformed financial inclusion in Kenya, and similar technologies are now being leveraged for agriculture-specific products.

New digital products worth exploring include:

- Weather station and satellite-based insurance

- Area-yield indices insurance

- Livestock and crop insurance

Programs like the Kenya National Agricultural Insurance Program, Global Index Insurance Facility, Kenya Livestock Insurance Programme, and ACRE Africa offer valuable learning opportunities and solutions that can be scaled across the food system.

Your Next Steps to Secure Funding

- Get your business basics right – Clean up your business plan, financial records, and legal status

- Research the right funding mechanism for your specific needs (grants for innovation, loans for expansion, etc.)

- Build your network – Connect with agricultural business associations and attend industry events

- Start small – Build credibility with smaller funding before going for big investments

- Embrace digital tools – Use digital platforms to build your financial history and access new financial products

Conclusion

The landscape of agribusiness funding in Kenya is evolving rapidly. From traditional loans to innovative digital financial solutions, these funding mechanisms can be the difference between a good idea and a thriving agricultural business.

As a young agripreneur, you’re in an ideal position to leverage both traditional funding sources and cutting-edge digital innovations. By understanding the available options and strategically positioning your business, you can access the capital needed to transform your agricultural vision into reality.

Remember, sustained investment in agribusiness remains critical for Kenya’s economic development, particularly in rural areas. By tapping into these funding opportunities, you’re not just building your business—you’re contributing to food security and economic growth across the country.

Are you already exploring any of these funding options? Drop a comment below and let us know which funding avenue looks most promising for your agricultural venture.

Frequently Asked Questions About Agribusiness Funding in Kenya

Who qualifies for agribusiness funding in Kenya?

Most funding initiatives in Kenya target registered businesses in the agricultural sector. Qualifications typically include having a viable business plan, some form of collateral (though this varies by program), and demonstrable capacity to repay loans or execute grant projects. Young entrepreneurs and women-led businesses often receive special consideration under many funding programs.

What’s the minimum amount I can apply for as a starting agripreneur?

Funding amounts vary widely across different programs. While large initiatives like AgriFI offer €200,000 at minimum, smaller microfinance institutions and SACCOs provide loans starting from as little as Ksh 10,000 (approximately $100). Start with an amount that matches your current scale and capacity.

Do I need collateral to access agricultural loans in Kenya?

Not always. Programs like the Kilimo Biashara Credit Guarantee Scheme are specifically designed to reduce collateral requirements. Additionally, some microfinance institutions accept alternative forms of security such as group guarantees or movable assets like livestock or equipment.

How long does the funding application process usually take?

The timeline varies significantly between funding sources. Commercial bank loans might be processed in 2-4 weeks, while grant applications through programs like AgriFI can take 3-6 months from application to disbursement. Plan your cash flow needs accordingly.

Are there funding options specifically for organic or sustainable agriculture?

Yes! Several international organizations and impact investors prioritize sustainable and climate-smart agricultural practices. The ABC Fund, for example, has specific focus areas for environmentally sustainable initiatives, while certain specialized grants target organic farming and conservation agriculture projects.

Can I combine different types of funding for my agribusiness?

Absolutely! Many successful agribusinesses use a blended finance approach. You might secure a grant for developing an innovative aspect of your business, take a loan for operational expenses, and perhaps even bring in an equity partner for longer-term growth. Just ensure the terms of each funding source don’t conflict with others.

What documents do I need to prepare before applying for funding?

While requirements vary, most funders will want to see:

- Business registration documents

- A comprehensive business plan

- Financial statements (if you’re already operating)

- Market analysis and growth projections

- Personal identification documents

- Land ownership or lease agreements (for farm-based businesses)

- Any relevant permits or licenses