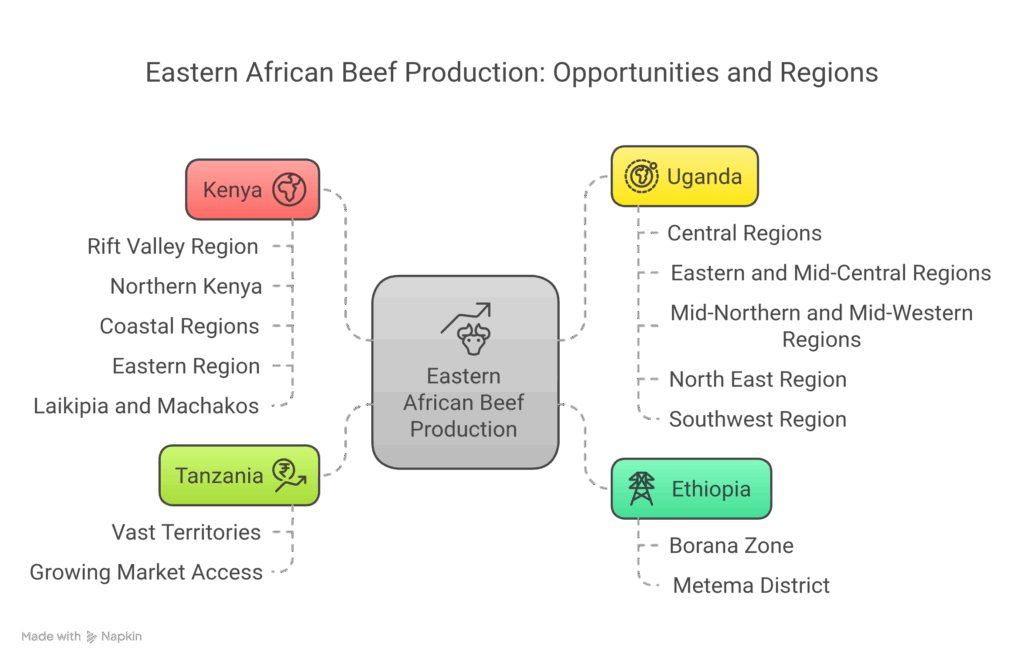

Looking for the next big agricultural investment play? Eastern Africa’s beef sector might be your answer. This powerhouse region hosts nearly 40% of Africa’s total cattle population—about 120 million animals grazing across diverse landscapes from highland plateaus to semi-arid plains.

The Big Four of Eastern African Beef Production

Four key countries dominate the beef scene here: Ethiopia, Kenya, Tanzania, and Uganda. Together, they’re sitting on a gold mine of opportunity that’s just waiting for the right investors to tap into. These countries collectively hold almost 40 percent of Africa’s total cattle herd. Let’s break down what makes each region tick.

Ethiopia: The Sleeping Giant

Ethiopia’s beef potential is massive, especially in its sprawling lowland territories. Two regions stand out:

Borana Zone (Southern Ethiopia) This semi-arid region has perfected the pastoral and semi-pastoral production systems over generations. The indigenous Borana cattle—possibly your best asset in this region—have adapted perfectly to these challenging conditions.

Northwestern Ethiopia (Metema District) Here’s a spot flying under most investors’ radar. Covering about 440,000 hectares, this district boasts the perfect beef cattle climate with temperatures between 22-28°C and 850-1100mm of annual rainfall. Research has identified this area as having “huge potential for beef cattle production”. Recent initiatives have focused on introducing Borana cattle from southern Ethiopia to improve production efficiency in this northwestern frontier.

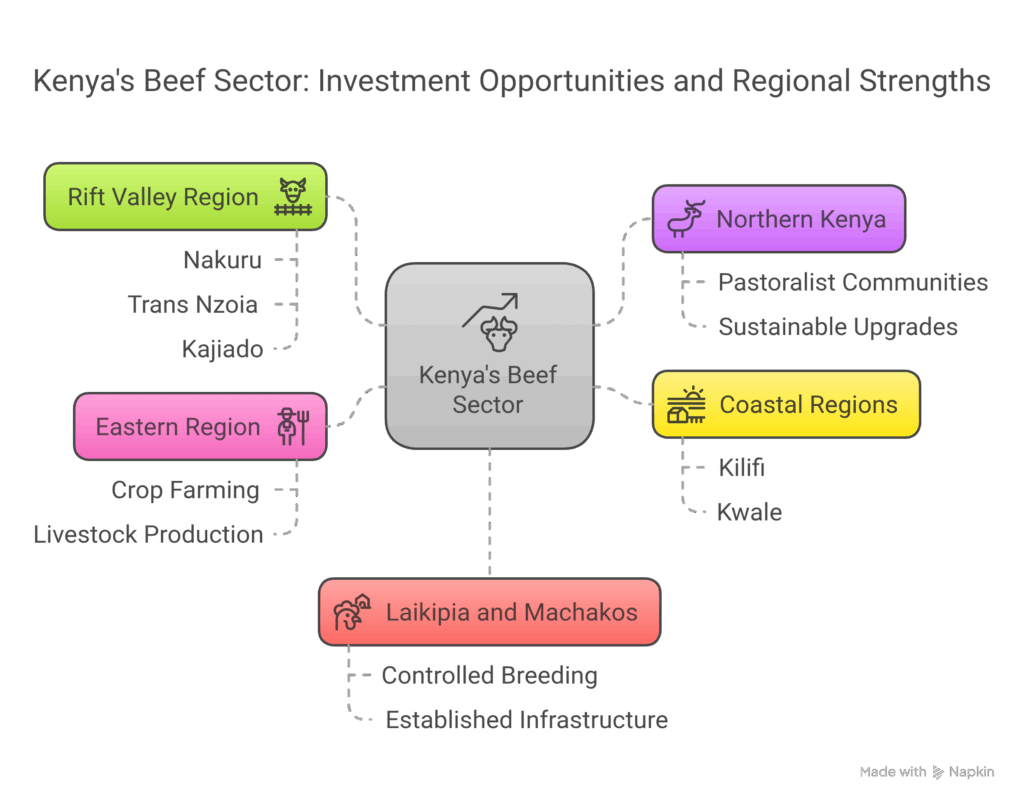

Kenya: The Market Leader

Kenya’s beef sector isn’t just established—it’s thriving, accounting for a whopping 36% of the country’s agricultural GDP. The country offers diverse investment landscapes:

Rift Valley Region Counties like Nakuru, Trans Nzoia, and Kajiado have built their reputation on ranching operations that provide ideal grazing conditions for commercial beef production. Many investors are already seeing solid returns here, but there’s room for innovation.

Northern Kenya Want to go traditional? This region supports extensive nomadic herding across vast grasslands, primarily managed by pastoralist communities with centuries of knowledge. Partnership opportunities abound for investors willing to respect cultural practices while introducing sustainable upgrades.

Coastal Regions Kilifi and Kwale counties represent significant ranching territory along Kenya’s coast. These areas have developed specific adaptations to the coastal climate—a competitive advantage for anyone looking to establish operations here.

Eastern Region This area practices considerable agro-pastoralism, combining crop farming with livestock production. It’s the perfect entry point for investors interested in integrated agricultural systems.

Laikipia and Machakos Known specifically for commercial ranching operations, these regions implement controlled breeding and modern production techniques. They’re essentially ready-made for investors seeking established infrastructure.

Uganda: The Diversified Player

Uganda’s cattle distribution shows fascinating regional specialization:

Central Regions Central 1 and Central 2 regions predominantly practice agro-pastoral (65%) and ranching (30%) systems, with a small percentage (5%) under semi-intensive management. This diversity gives investors multiple entry points.

Eastern and Mid-Central Regions Almost exclusively agro-pastoral, with 98-99% of beef cattle raised in this system. These areas offer a strong foundation for investors looking to build on traditional practices.

Mid-Northern and Mid-Western Regions High concentrations of agro-pastoral beef production (95% and 90% respectively) characterize these territories, making them ideal for specific investment strategies centered around enhancing existing systems.

North East Region Standing apart with 94% of beef cattle under pastoral systems, this region offers unique opportunities for investors interested in nomadic production models.

Southwest Region With a more mixed approach—70% agro-pastoral, 20% ranching, and 10% semi-intensive beef production—the Southwest presents perhaps the most versatile investment landscape in Uganda.

Tanzania: The Rising Star

While detailed regional information for Tanzania is more limited, the country is confirmed as one of Eastern Africa’s major cattle producers. Tanzania’s vast territories and growing market access make it an emerging opportunity that savvy investors should watch closely.

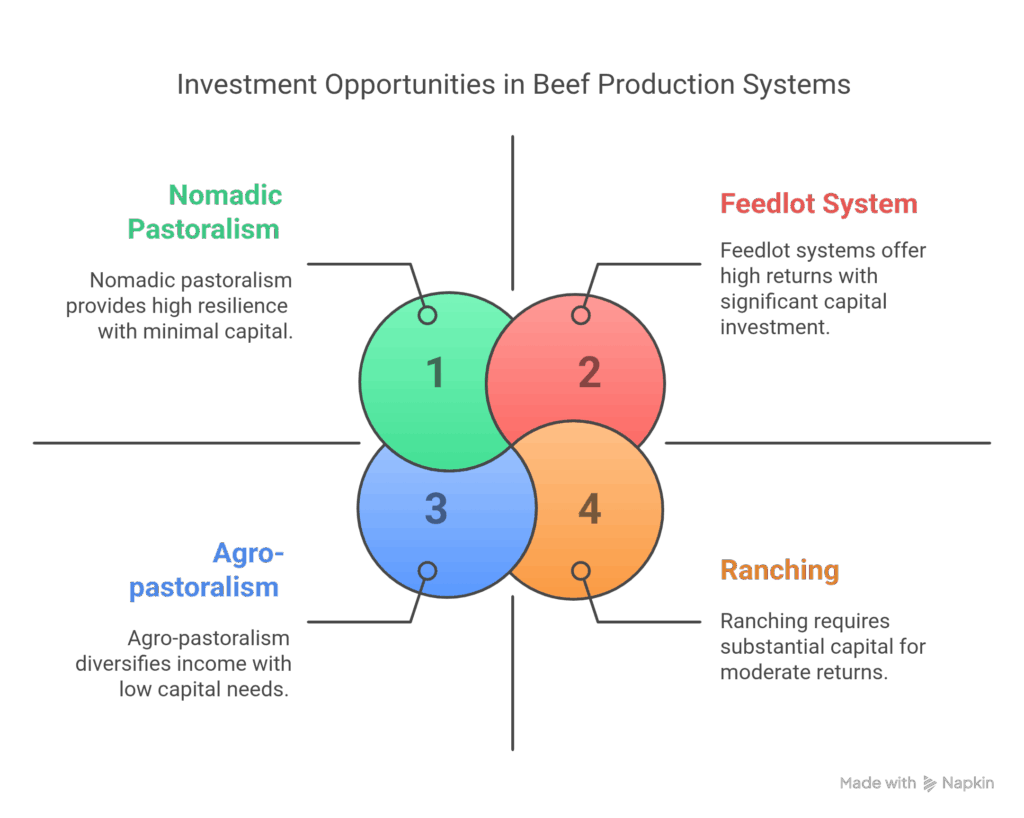

Production Systems: Your Investment Options

Understanding the various production systems is crucial for making smart investment decisions in Eastern Africa’s beef sector. Each system offers different risk profiles, capital requirements, and return potential.

Nomadic Pastoralism: Low Input, High Resilience

This traditional system—moving cattle over large areas searching for pasture and water—dominates dry regions with variable rainfall. It accounts for approximately 60% of Kenya’s beef production and is the predominant system in northern Kenya. In Uganda’s northeastern region, 94% of beef cattle are raised under pastoral systems.

Investment angle: While requiring lower capital investment, pastoralism offers opportunities in mobile technology integration, water management solutions, and premium positioning for grass-fed, free-range beef products.

Ranching: The Commercial Standard

Representing a more formalized production system in areas with better infrastructure and market access, ranching features:

- Large-scale, commercially-oriented operations

- Controlled breeding programs

- Modern animal health management

- Located in ecologically favorable areas

Ranching thrives in Kenya’s Laikipia and Machakos regions, parts of the Rift Valley including Nakuru, Trans Nzoia, and Kajiado. In Uganda, it accounts for 30% of beef production in the Central regions and 20% in the Southwest.

Investment angle: Higher initial capital requirements but offers more predictable returns and scaling potential. Prime opportunities exist in genetics, animal health tech, and marketing infrastructure.

Agro-pastoralism: The Integrated Approach

This integrated system combines crop farming with livestock production, providing diversified income sources for farmers in semi-arid regions. It’s particularly prevalent in Eastern and Rift Valley regions of Kenya and across many regions of Uganda, where it accounts for 65-99% of beef production depending on the area.

The system efficiently utilizes crop residues for cattle feeding while cattle provide draft power and manure for crop production—a circular economy in action.

Investment angle: Offers risk diversification and multiple revenue streams. Look for opportunities in integrated farming technology, byproduct utilization, and creating value-added products.

Feedlot System: The Emerging Intensive Option

Growing in importance, especially in Kenya, feedlot systems represent the most intensive beef production approach in the region. These operations:

- Focus on fattening cattle with high-energy concentrates

- Require capital-intensive infrastructure

- Are strategically located near urban centers to supply premium markets

Investment angle: Higher returns possible with shorter production cycles. Prime areas for investment include feed technology, genetics for faster weight gain, and supply chain optimization.

What’s Driving the Distribution: Key Factors for Investors

Several factors determine where beef farming thrives across Eastern Africa and what production systems dominate different areas.

Ecological Conditions: Nature’s Blueprint

The region’s diverse climate and topography significantly influence beef production patterns. The Arid and Semi-Arid Lands (ASALs) that comprise 89% of Kenya’s landmass are particularly suited to indigenous cattle breeds like the East African Zebu, which demonstrate exceptional heat tolerance, disease resistance, and ability to utilize low-quality forage.

In Ethiopia, the similarities between the Borana zone and Metema district in terms of altitude, rainfall patterns, and temperature ranges have facilitated the successful introduction of Borana cattle to northwestern Ethiopia. These ecological adaptations are critical determinants of which breeds and production systems are viable in specific regions.

Investment insight: Climate change resilience should be a central consideration in any beef investment strategy for the region. Indigenous breeds offer significant advantages here.

Market Access: The Commercial Factor

Proximity to markets influences production intensity and commercialization levels. Feedlot systems are developing near urban centers where premium beef markets exist, while remote areas rely more on extensive systems that require less external input but produce cattle that must travel long distances to reach markets.

Investment insight: Transportation infrastructure and cold chain development represent significant opportunity areas, potentially unlocking value in remote high-production regions.

Cultural Traditions: The Human Element

Traditional cattle-keeping cultures, particularly among pastoralist communities in northern Kenya, northeastern Uganda, and parts of Ethiopia, maintain extensive grazing systems deeply integrated with their social structures and cultural identities. These cultural factors significantly influence beef farming practices and distribution.

Investment insight: Successful ventures will respect and integrate with local cultural practices rather than attempting to replace them. Partnership models with indigenous communities often outperform imposing external systems.

The Investment Opportunity: Why Eastern African Beef Now?

Growing Domestic Demand

Eastern Africa’s rapid urbanization and expanding middle class are driving unprecedented demand for quality protein sources. Beef consumption is rising across major cities like Nairobi, Addis Ababa, and Kampala—creating reliable local markets beyond export opportunities.

Export Potential

The global demand for grass-fed, sustainably raised beef continues to grow. Eastern Africa’s predominant production systems—which rely heavily on natural grazing rather than grain feeding—position the region perfectly to capitalize on this trend.

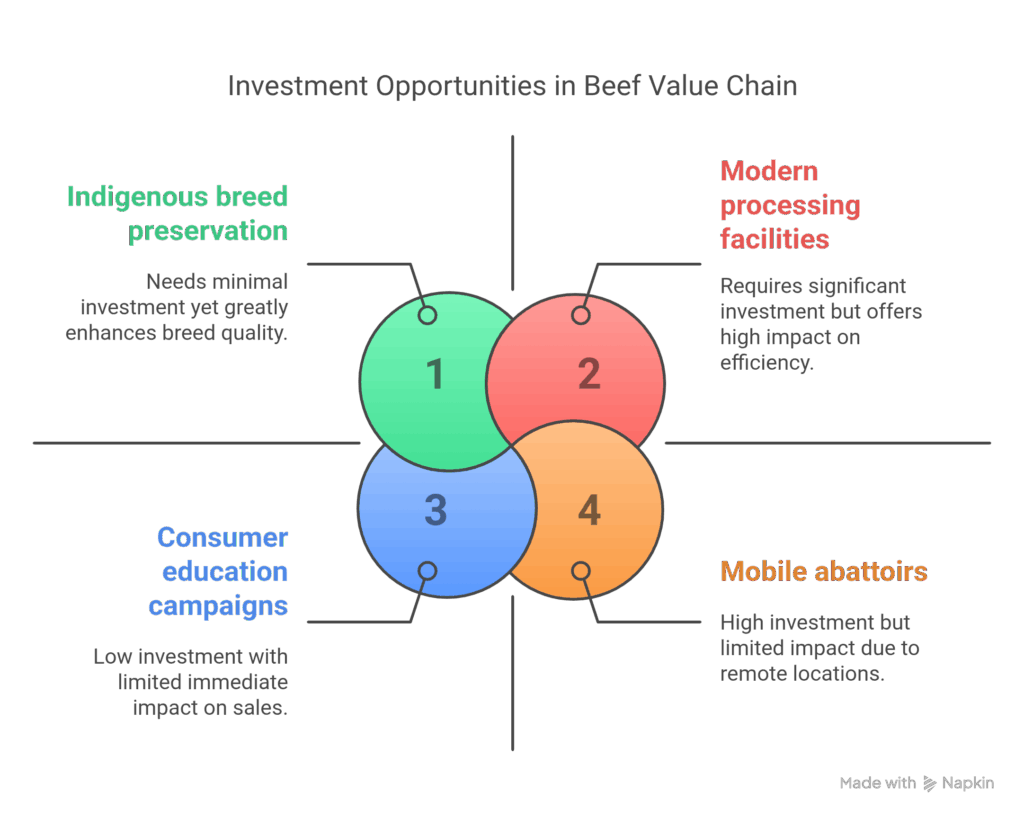

Value Chain Gaps as Investment Openings

The current beef value chain in Eastern Africa shows significant gaps that represent prime investment opportunities:

Genetics and Breeding

- Indigenous breed preservation and improvement programs

- Crossbreeding initiatives to balance adaptability with production characteristics

- Artificial insemination and embryo transfer services

Feed Production and Utilization

- Drought-resistant fodder development

- Crop residue processing technology

- Supplementary feed production using local ingredients

Processing and Cold Chain

- Mobile abattoirs for remote areas

- Modern processing facilities with international certifications

- Cold chain solutions for transport from remote production zones

Branding and Marketing

- Geographic indication development for region-specific beef

- Traceability systems for export markets

- Consumer education campaigns on beef quality

Sustainable Practices: The Future of Eastern African Beef

Investors looking toward long-term returns need to consider sustainability as core to their strategy in this region. Several approaches show particular promise:

Climate-Smart Grazing Management

Planned rotational grazing systems that mimic natural herbivore patterns are showing remarkable results in ecosystem restoration while maintaining or improving cattle production. These systems are particularly well-suited to the ranching areas of Kenya and Uganda.

Carbon Sequestration Potential

Properly managed grasslands—which dominate beef production landscapes in Eastern Africa—can sequester significant amounts of carbon. As carbon markets mature, this could represent an additional revenue stream for beef operations.

Indigenous Knowledge Integration

The pastoralist communities of northern Kenya, Ethiopia, and northeastern Uganda have developed sophisticated animal husbandry practices over centuries. Incorporating this knowledge into modern production systems offers sustainability advantages that purely industrial approaches lack.

Water Management Innovation

Water remains the limiting factor for beef production across much of Eastern Africa. Technologies for rainwater harvesting, borehole management, and efficient irrigation represent key investment areas with benefits across production systems.

Cultural Significance: Why It Matters to Your Investment

Understanding the cultural significance of cattle in Eastern African societies isn’t just interesting—it’s essential for successful investment in the region.

Beyond Economics: The Social Role of Cattle

In many communities, especially among pastoralist groups, cattle represent far more than economic assets. They function as social currency, determine social status, and play central roles in key ceremonies from marriages to coming-of-age rituals.

Investment implication: Projects that acknowledge and respect these cultural dimensions typically encounter less resistance and greater community support.

Indigenous Knowledge Systems

Local communities possess generations of accumulated knowledge about animal behavior, disease resistance, weather patterns, and grazing management. This knowledge constitutes an invaluable asset that should be recognized and integrated into any beef farming investment.

Community Partnership Models

The most successful beef ventures in the region have moved beyond simple employment relationships to genuine partnership models with local communities. These arrangements ensure sustainable access to land and labor while providing communities with agency in the development process.

Getting Started: Your Next Steps for Eastern African Beef Investment

Ready to explore this opportunity further? Here’s your roadmap:

- Regional Reconnaissance

- Identify target regions based on your preferred production system and risk profile

- Conduct on-the-ground assessment of ecological conditions and infrastructure

- Engage with local community leaders and existing producers

- Regulatory Navigation

- Research land access regulations in your target country

- Understand export certification requirements if targeting international markets

- Identify available investment incentives for agricultural ventures

- Partnership Development

- Connect with local producers’ associations

- Explore public-private partnership opportunities with regional governments

- Consider academic partnerships with agricultural research institutions

- Sustainable Planning

- Develop integrated plans that address ecological, economic, and social dimensions

- Build climate change adaptation strategies into your business model

- Consider certification pathways for premium market access

Conclusion: Eastern Africa’s Beef Promise

Eastern Africa’s beef sector represents a compelling investment opportunity with room for innovation across the value chain. From Ethiopia’s vast lowlands to Kenya’s ranching territories and Uganda’s diverse production landscape, the region offers multiple entry points for investors with different risk appetites and impact goals.

The successful investors in this space will be those who understand the interplay between ecological conditions, market access, and cultural traditions—using this knowledge to develop approaches that respect local contexts while introducing innovations that boost productivity and sustainability.

For those willing to take a patient, partnership-oriented approach, Eastern Africa’s beef farming regions offer rare potential: the chance to generate competitive returns while contributing to food security, livelihood development, and climate resilience across one of the world’s most dynamic regions.

Frequently Asked Questions

What are the main beef cattle breeds found in Eastern Africa?

Eastern Africa features both indigenous and exotic beef cattle breeds. Indigenous breeds like the Boran, East African Zebu, Ankole, and Ethiopian Boran dominate due to their exceptional adaptation to local conditions. They demonstrate high heat tolerance, disease resistance, and ability to thrive on low-quality forage. For commercial ranching operations, crossbreeds between indigenous cattle and exotic breeds like Hereford, Angus, and Brahman are increasingly common, combining local resilience with improved productivity traits.

What’s the typical ROI timeline for beef farming investments in Eastern Africa?

Return on investment timelines vary significantly based on the production system. Intensive feedlot operations can show returns within 1-2 years, while ranching operations typically require 3-5 years to reach full profitability. Investments in pastoralist systems often have longer timelines of 5-7 years but may offer more stable long-term returns once established. The most successful investments tend to be phased, with incremental scaling as local relationships and operational efficiencies are established.

How does land access work for foreign investors in Eastern Africa’s beef sector?

Land access regulations vary by country. Kenya offers long-term leases (typically 33-99 years) for commercial agricultural ventures, while Ethiopia uses a concessional model with performance requirements. Uganda provides more flexible arrangements through joint ventures with local partners. In all cases, community engagement is crucial—successful investors typically develop benefit-sharing models with local communities rather than pursuing land acquisition alone. Working with established local partners who understand the formal and informal aspects of land access is highly recommended.

What are the main challenges facing beef production in Eastern Africa?

Key challenges include climate variability and drought risk, disease management (particularly tick-borne diseases like East Coast Fever), market access limitations in remote areas, and sometimes unpredictable policy environments. Water access remains a critical constraint across much of the region, while competition between beef production and other land uses is increasing in high-potential areas. However, each of these challenges also represents an investment opportunity for solutions providers.

How does Eastern African beef farming compare to Western ranching models?

Eastern African beef systems are generally more diversified and integrated than Western models. While American ranching typically separates cow-calf operations, stockers, and feedlots as distinct businesses, Eastern African approaches often combine elements of all three within single operations. Eastern African systems also tend to place greater emphasis on multi-use landscapes (wildlife conservation, tourism, carbon sequestration) and often incorporate multiple livestock species (cattle, sheep, goats, camels) as risk management strategy.

What financing options are available for beef investments in Eastern Africa?

The financing landscape includes traditional commercial lending, development finance institutions (DFIs) offering concessional terms for impactful projects, private equity focusing on agricultural transformation, and increasingly impact investors seeking both financial and sustainability returns. Grant funding is also available for innovative approaches, particularly those addressing climate resilience or smallholder integration. Blended finance structures combining commercial capital with impact-first investments have shown particular promise in this sector.

How are Eastern African beef operations addressing climate change?

Forward-thinking operations are implementing multiple strategies: diversifying water sources through rainwater harvesting and precision irrigation, introducing drought-resistant fodder species, developing carbon credit revenue streams through improved grazing management, establishing fodder banks for drought periods, and in some cases shifting to more drought-tolerant livestock species like camels to complement traditional cattle operations. Mobile technology is increasingly deployed for early warning systems and market access during climate stress periods.

What certifications should investors consider for premium market access?

For export markets, key certifications include organic certification (particularly relevant for pastoral and agro-pastoral systems that are often organic by default), Global G.A.P. for good agricultural practices, and increasingly animal welfare certifications. For the growing domestic premium markets, local certifications like Kenya’s Livestock Identification and Traceability System (LITS) are gaining importance. Several initiatives are also developing sustainability certifications specific to African livestock systems that could command premium pricing in both domestic and export markets.

This article was crafted with insights from comprehensive research on Eastern African beef farming practices. For more detailed information on specific aspects of Eastern African beef production, explore the embedded links throughout this article.