The Next Big Thing in Agricultural Investment

Looking for that under-the-radar investment play before everyone else jumps on board? While tech bros are chasing the next AI unicorn, the real money move might be growing in Kenya’s lush highlands.

Purple tea—Kenya’s breakout agricultural star—isn’t just another commodity crop. It’s a premium product that’s commanding serious price tags in international markets and creating wealth opportunities that savvy investors shouldn’t ignore.

After spending 25 years in development at the Tea Research Foundation of Kenya, this uniquely colored tea variety has evolved from research project to commercial powerhouse. And here’s the kicker – it’s selling for up to ten times what regular black tea fetches.

The Numbers That Should Make Investors Take Notice

Let’s cut to what matters – the financials. Purple tea isn’t playing in the same league as commodity black tea:

| Tea Type | Average Price Per Kilogram | Market |

|---|---|---|

| Standard Black Tea | $2.85 | Mombasa Auction |

| Purple Tea | Up to $30 | International Wholesale |

That’s not a typo. We’re talking about a potential 10x value premium over conventional tea. If you’re an investor who understands the power of premium positioning in agricultural markets, these numbers should have your attention.

North America has emerged as the top export destination, with U.S. and Canadian wholesalers importing approximately 10 metric tons of Kenya’s purple tea in recent years. International Tea Importers (ITI) in California has positioned itself as the largest purple tea importer in North America, recognizing early what many investors are just now discovering.

As Bhavin Shah, COO at ITI puts it: “We are on the brink of something new and exciting in the tea industry. This is arguably the first true innovation in the Camellia Sinensis plant since its inception thousands of years ago.”

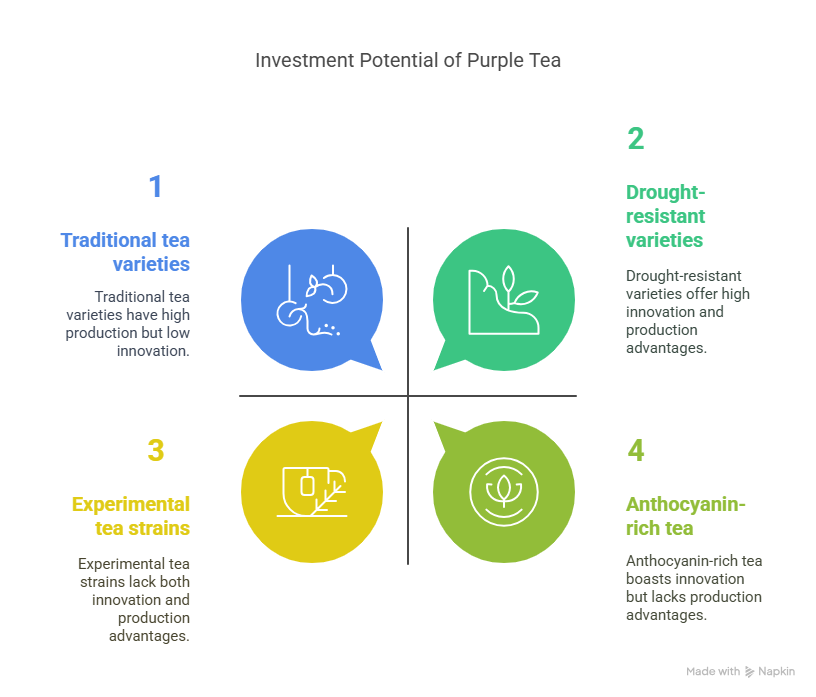

Why Purple Tea Has Serious Investment Potential

The investment case for purple tea isn’t just about higher prices – it’s about fundamental advantages that create sustainable value:

1. Scientific Innovation With Real-World Value

This isn’t some marketing gimmick. Purple tea’s distinctive color comes from anthocyanins – the same antioxidants found in blueberries and other superfoods. These compounds give the tea genuinely higher antioxidant levels and lower caffeine than traditional teas, creating authentic appeal for health-conscious consumers.

After dedicating a quarter-century to its development, Kenya’s Tea Research Foundation created varieties that are drought-resistant, disease-resistant, and frost-resistant. That means lower growing risks and more consistent production – music to any agricultural investor’s ears.

2. Production Advantages That Drive Profitability

The TRFK 306/1 purple tea bushes yield between 1.5 to 3 kilograms per year, outperforming most traditional tea varieties. Higher yields plus premium pricing equals serious profit potential.

Take Umbui purple tea farm as an example. This 4.4-hectare property in Murang’a County, owned by local entrepreneur Darius Kizito, has created new revenue streams for entire communities. “I see a bright future for purple tea in this country. Farmers have realized it is more profitable compared to black tea,” Kizito notes.

3. Government Backing That Reduces Investment Risk

The Kenyan government isn’t just watching from the sidelines – they’re putting serious money on the table. They’ve committed approximately 1 billion Kenyan shillings (about 7 million euros) specifically to encourage value addition in the tea sector.

This strategic investment aims to create jobs, increase earnings, and develop enterprises throughout the tea value chain. Value addition has the potential to increase smallholder farmers’ incomes by up to 40 percent compared to conventional tea.

The Growth Stats That Matter to Investors

Kenya’s overall tea exports surged 20.8 percent in the first ten months of 2024 compared to the same period in 2023, according to recent reports. While these figures include all tea varieties, specialty teas like purple tea contribute significantly to this positive trend.

Kenya already dominates as the world’s biggest exporter of black tea and third-largest tea producer overall. Tea serves as a central pillar of Kenya’s economy and a leading foreign exchange earner. The diversification into high-value specialty teas like purple tea only strengthens the country’s agricultural position.

The Value-Add Opportunity Most Investors Are Missing

Here’s where it gets really interesting for investors with vision. Currently, only 5 percent of Kenya’s tea undergoes value addition processes, but this figure is expected to rise to 50 percent by 2027 due to concerted government efforts.

Smart money should be watching companies that:

- Control the processing chain: Facilities like Gatanga Industries Tea Factory in Murang’a County are crucial in preparing purple tea for export markets.

- Have direct farmer relationships: Companies like LEAFBERRI source directly from small-scale farmers, eliminating middlemen and creating more sustainable supply chains.

- Target premium international markets: Wholesale blends of purple tea sell for between $19 and $30 per kilogram in places like North America, Europe, and China.

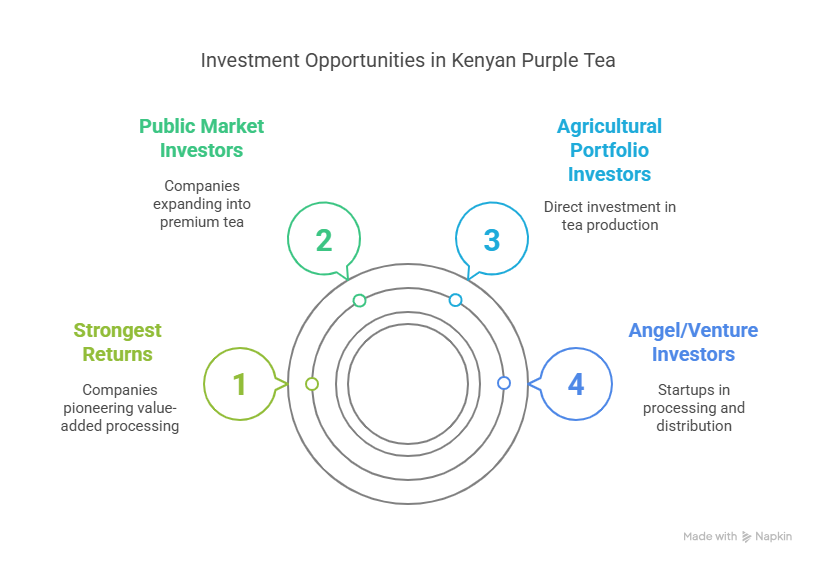

Investment Entry Points You Should Consider

So how do you get in on this opportunity? Here are the practical play options for different investor profiles:

For Angel/Venture Investors

Look for startups focused on tea processing, value-added products, and international distribution of Kenyan purple tea. The processing technology sector is particularly interesting, as expertise from China is currently being imported to enhance processing capabilities.

For Agricultural Portfolio Investors

Consider direct investment in production operations in Kenya’s central highlands, particularly in regions like Murang’a County with its rich volcanic soils that are perfect for purple tea cultivation.

For Public Market Investors

Watch for tea companies expanding into the premium segment who mention purple tea in their strategy. The companies pioneering value-added processing will likely deliver the strongest returns as the sector matures.

The Risks You Need to Know

No investment thesis is complete without understanding the challenges. For purple tea, these include:

- Market education hurdles: Many consumers worldwide remain unfamiliar with purple tea and its benefits, creating marketing costs.

- Quality standardization: As production scales, maintaining premium characteristics consistently will be essential.

- Value chain development: The infrastructure for processing and distribution is still developing in many regions.

Why This Opportunity Won’t Last Forever

The purple tea investment window has a limited timeframe. As World Tea News reports, interest is growing rapidly. North America has already emerged as the top export destination, with major wholesalers securing supply chains.

The real opportunity lies in the value-addition gap. As Solidaridad Network reports, companies that develop branded, ready-to-consume purple tea products will capture significantly more value than those exporting raw tea.

The Smart Investor’s Next Steps

If you’re intrigued by the purple tea opportunity, here’s your action plan:

- Research companies specifically focused on Kenyan purple tea production, processing, or distribution.

- Consider the potential for direct agricultural investment through partnerships with existing operations.

- Monitor the Kenyan government’s ongoing initiatives to support value addition in the tea sector, as these will create ripple effect opportunities.

- Look for early-stage brands positioning themselves in health-conscious markets with purple tea products.

Bottom Line: Is Purple Tea Worth Your Investment Dollars?

Kenya’s 25-year research investment has created something genuinely unique in the agricultural export market. Purple tea combines the stability of an established industry with the premium pricing of an emerging health product.

While commodity investors chase diminishing returns, purple tea represents that sweet spot of innovation within a proven market. The production fundamentals are solid, the price premium is significant, and the value-addition opportunities are just beginning to be explored.

For investors who understand that sometimes the best opportunities aren’t in Silicon Valley but in the fertile highlands of countries like Kenya, purple tea deserves serious consideration in your alternative investment portfolio.

Want to discuss specific investment opportunities in Kenya’s purple tea sector? Drop a comment below or reach out directly to schedule a consultation.

This article was researched using information from World Tea News, LEAFBERRI, Xinhua News, Solidaridad Network, and additional market reports.